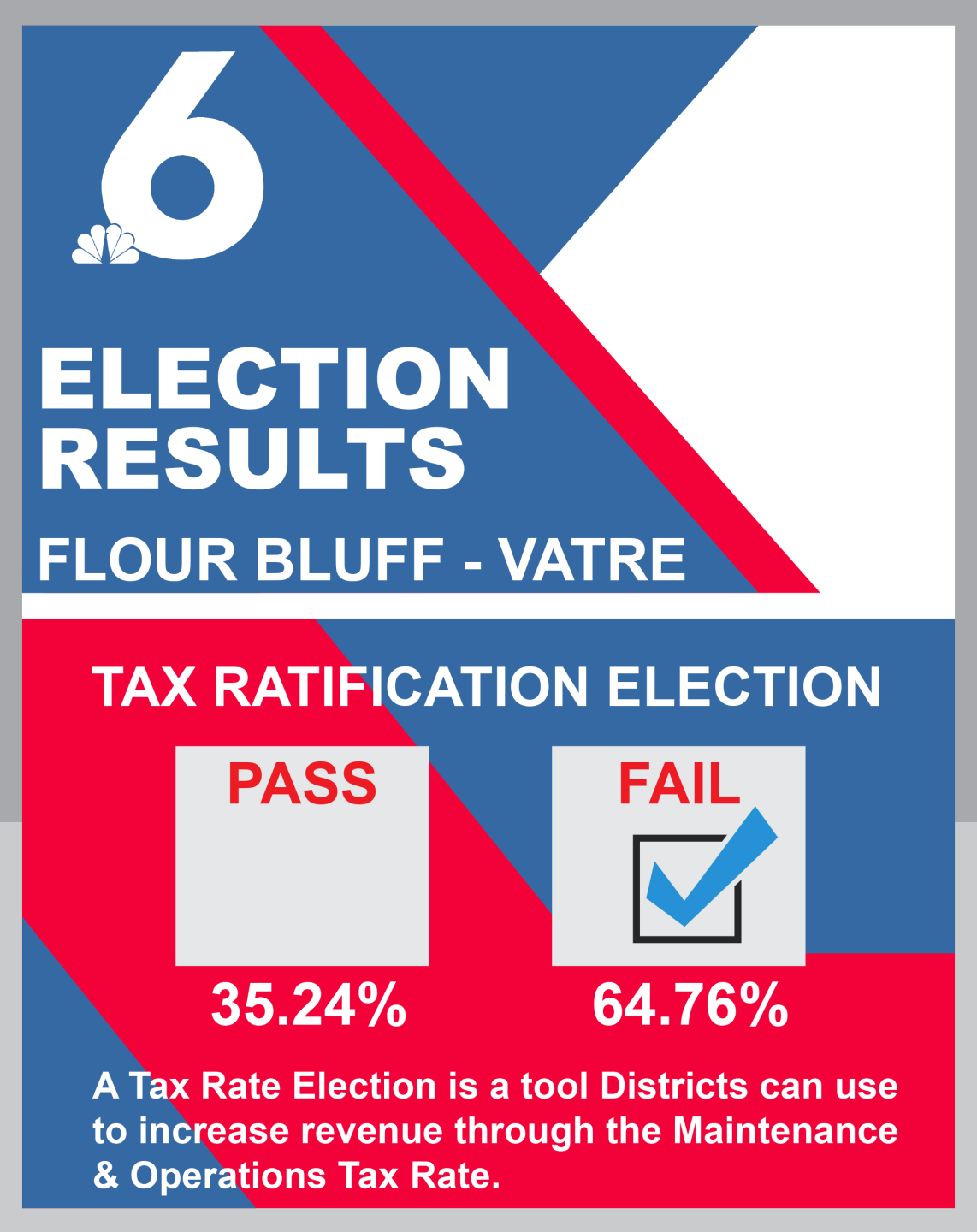

UPDATE (Nov. 8):

Residents voted against the measure during Tuesday's general election.

ORGINAL:

An item on the ballot that could impact some local neighbors' wallets is Flour Bluff Independent School District’s voter-approval tax ratification election or VATRE.

The district is asking voters to approve a 0.9986 tax rate, a .07 increase in taxes than what the state has already set for next year.

“All we’re asking is for taxpayers to sustain last year’s tax rate,” Velma Soliz-Garcia, the FBISD superintendent, said. “Last year’s tax rate is a dollar. A dollar. $1.0063. All we’re doing is asking them to vote for those seven pennies that we are asking to recover.”

The rate is lower than previous ones, but it would raise $3.4 million more because property values have increased.

“It is raising the taxes,” Kevin Kieschnick said. “They’re increasing their levy.”

Kieschnick, the Nueces County tax accessor, said the appraisal rates in Flour Bluff went up an average of 12 percent in 2022.

“It doesn’t mean that everyone had a 12 percent increase,” Kieschnick said. “Some people had a 20 percent increase, some people had next to nothing; but overall, the average or the entire district is around 12 percent.”

And when property values in a district go up, the money the state believes a district needs decreases.

“This last year was the hardest year we were hit,” Soliz-Garcia said.

She said they have a lower tax rate than other districts, but they also have historically paid lower.

She added in 2022, they approved teacher and staff pay raises but they need more funds to maintain those raises and remain competitive.

The state already approved a 0.9286 tax rate, but district officials said it needs to be higher by seven cents.

“Their money is going towards helping us pay our teachers to be competitive, to be a better competitive pay scale, to recruit the best teachers, and to keep and maintain the teachers that we have,” Soliz-Garcia said.

She said the other 20 percent would go towards safety, security, and programs for students.

If the VATRE passes, the owner of a $200,000 property, would pay $140 more in taxes a year.

But what happens if the VATRE fails?

Soliz-Garcia said the district will face a $2.6 million deficit for the 2024 budget cycle.

“We would have to look out our staffing ratios,” she said. “Class sizes would probably continue to increase and then we would have to look at programs.”

The superintendent said they would have to put a plan in place for their next opportunity which can only be put on a ballot in a general election year.

To view the VATRE information visit the FBISD website.